Explore Top Credit Unions in Cheyenne: High Quality Financial Solutions

Explore Top Credit Unions in Cheyenne: High Quality Financial Solutions

Blog Article

Open the Conveniences of a Federal Lending Institution Today

Explore the untapped benefits of straightening with a government lending institution, a tactical financial action that can change your banking experience. From exclusive participant perks to a strong area values, federal cooperative credit union supply an unique method to financial solutions that is both financially advantageous and customer-centric. Discover how this different banking version can offer you with an unique viewpoint on economic wellness and long-term stability.

Advantages of Joining a Federal Cooperative Credit Union

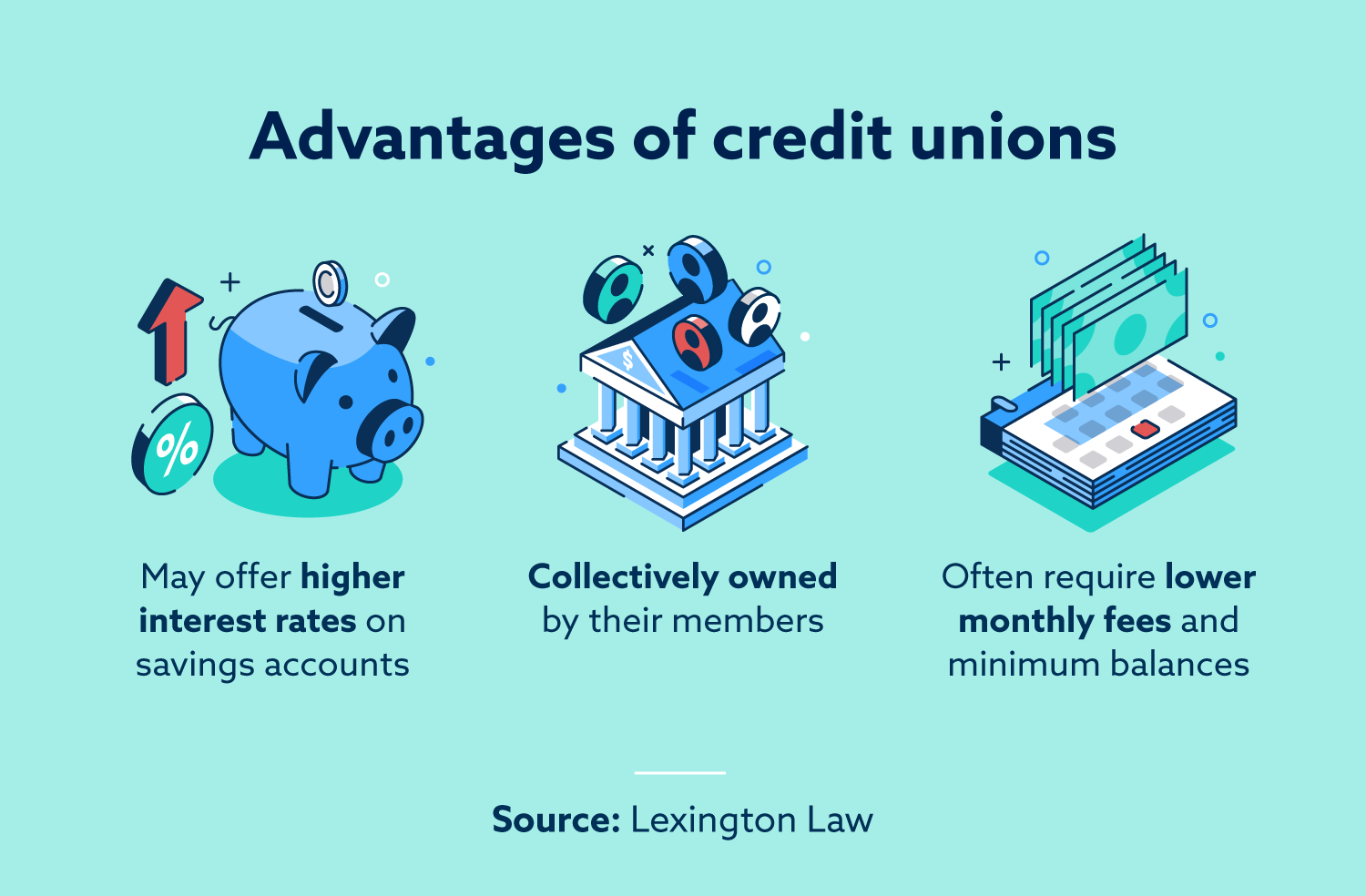

Signing Up With a Federal Credit rating Union uses people access to numerous monetary solutions and advantages not typically offered at standard financial institutions. One of the main benefits of signing up with a Federal Lending institution is the focus on participant contentment instead of generating profits for shareholders. This member-focused method commonly converts right into much better customer support, as Lending institution prioritize the needs of their members most of all else. In Addition, Federal Credit rating Unions are not-for-profit organizations, allowing them to provide competitive rate of interest on cost savings accounts, financings, and charge card.

An additional advantage of joining a Federal Cooperative credit union is the feeling of neighborhood and belonging that members often experience. Credit Unions are member-owned and ran, implying that each participant has a stake in the organization. This can cultivate a sense of commitment and count on in between members and the Cooperative credit union, bring about a much more tailored banking experience. Last But Not Least, Federal Credit score Unions typically supply financial education and learning and resources to assist participants improve their economic proficiency and make educated decisions regarding their cash.

Reduced Costs and Affordable Prices

In addition, government credit score unions are understood for supplying affordable passion prices on financial savings accounts, loans, and credit scores cards. By providing these affordable rates, federal credit unions prioritize the financial health of their members and strive to assist them achieve their economic goals.

Individualized Client Service

A characteristic of federal credit scores unions is their dedication to supplying individualized customer support tailored to the specific needs and choices of their members. Unlike standard financial institutions, federal cooperative credit union focus on building strong partnerships with their members, intending to supply a much more tailored experience. This customized strategy implies that participants are not simply seen as an account number, but instead as valued people with distinct economic objectives and situations.

One means government lending institution deliver customized customer care is through their member-focused method. Agents make the effort to understand each member's particular economic scenario and deal personalized remedies to fulfill their requirements. Whether a member is seeking to open a new account, look for a financing, or seek economic advice, federal lending institution strive to supply customized advice and assistance every action of the means.

Community-Focused Campaigns

To additionally enhance their influence and connection with participants, federal cooperative credit union actively participate in community-focused campaigns that contribute to the health and advancement of the locations they serve. These campaigns usually include economic education programs intended at empowering individuals with the expertise and skills to make enlightened decisions regarding their finances (Wyoming Federal Credit Union). By using workshops, workshops, and one-on-one counseling sessions, credit rating unions assist area members enhance their economic proficiency, manage financial obligation successfully, and plan for a protected future

In addition, government credit report unions regularly join local events, sponsor neighborhood tasks, and assistance charitable causes to deal with certain needs within their solution locations. This participation not just demonstrates their commitment to social responsibility however likewise reinforces their relationships with members and fosters a sense of belonging within the community.

Through these community-focused efforts, federal lending institution play a vital role in promoting financial inclusion, economic security, and total success in the regions they operate, eventually producing a positive impact that extends beyond their traditional financial solutions.

Optimizing Your Membership Benefits

When wanting to take advantage of your membership Credit Unions Cheyenne advantages at a cooperative credit union, comprehending the range of services and sources available can dramatically improve your economic wellness. Federal cooperative credit union use a variety of advantages to their participants, including competitive interest rates on interest-bearing accounts and financings, reduced fees contrasted to standard banks, and customized customer care. By making the most of these benefits, participants can enhance their financial security and achieve their objectives a lot more efficiently.

Additionally, getting involved in monetary education and learning programs and workshops offered by the credit rating union can assist you improve your money management abilities and make more enlightened decisions about your financial future. By actively engaging with the resources offered to you as a participant, you can open the complete possibility of your relationship with the credit scores union.

Verdict

To conclude, the benefits of signing up with a government credit scores union include lower fees, competitive rates, customized client service, and community-focused efforts. By maximizing your membership benefits, you can access price savings, customized remedies, and a feeling of belonging. Take into consideration opening the benefits of a federal credit report union today to experience a banks that focuses on participant fulfillment and provides a series of resources for economic education and learning.

In Addition, Federal Debt Unions are not-for-profit companies, enabling them to provide competitive passion prices on savings accounts, car loans, and credit history cards.

Federal Credit report Unions typically offer financial education and learning and resources to aid members improve their monetary proficiency and make educated decisions about their cash.

:max_bytes(150000):strip_icc()/6-benefits-of-using-a-credit-union.aspx_final-6e501699186e429ab6458d9e36ebe4a1.jpg)

Report this page